16+ non qm mortgage

We Are Available 7 Days a Week. Web Newfi a technology-based multi-channel mortgage lender is the first lender in the non-qualified mortgage Non-QM channel to utilize Tavants Touchless Lending system.

The Different Types Of Non Qm Loan Products

QM loans have a regulated formula to which mortgage providers must adhere so if a borrower.

. As a result they present a greater risk and typically come with higher interest rates. Tavant a Silicon Valley-based provider of digital lending solutions said Wednesday it has teamed with Newfi Lending to integrate its digital document analysis into Newfi. A qualified mortgage meets the CFPSs ability to repay rule which requires that lenders vet your finances thoroughly and set terms on the loan so that you are more likely to be able to repay the loan.

Anyone who is not an employee of a company is considered self-employed Such people find it hard to. A qualified mortgage meets the CFPBs ability to repay rule which requires that lenders vet your finances and set terms on the loan that youre likely to be able to pay back. Web Figure 2 shows the trend of 3 major factors of underwriting for all home purchase loans.

Web On February 23 2022 the Bureau released a factsheet on the interest rate that is used for calculating prepaid interest under the price-based General QM APR calculation rule for certain ARMs and step-rate loans. Talk To Us And We Can Make It Work. Web Non-QM loans arent eligible for purchase by Freddie Mac or Fannie Mae nor do they come with government backing like FHA and VA loans do for example.

Web By the end of the year some experts predict that the non-QM market will as much as quadruple to 100 billion. A non-qualified mortgage or non-QM is a home loan that is not required to meet agency-standard documentation requirements as outlined by the Consumer Financial Protection Bureau CFPB. Web A Non-QM loan or a non-qualified mortgage is a type of mortgage loan that allows you to qualify based on alternative methods instead of the traditional income verification required for most loans.

Web Non-QM mortgage rates tend to be slower to respond to movements in broader market rates than those in the primeconforming space. Web A Qualified Mortgage is a category of loans that have certain less risky features that help make it more likely that youll be able to afford your loan. Home loans exceeding 30-year terms.

Web Because non-QM or non-prime mortgages are deemed riskier than prime loans in a normal market they generally command an interest rate about 150 basis points above conforming rates. Web Non-QM loans are mortgages that dont meet the Consumer Financial Protection Bureaus CFPB requirements to be considered qualified mortgages. Web Non-QM loans as they are known are a small but significant segment of the mortgage market.

Similarly the average LTV for borrowers with non-QM was. For the bank statement loan youll provide 12 months bank statements personal or business. Web Non-conforming loans often referred to as non-QM loans are a type of mortgage that some lenders offer to help these types of borrowers qualify for a loan.

This is known as the ability-to-repay rule. This is called a Bank Statement Mortgage loan program. Common examples include bank statements or using your assets as income.

Non-QM loans may encapsulate a wide variety of mortgages including. These tend to be high-value home loans that are not backed by the Federal Housing Administration. Veterans Get The Benefits You Deserve For Your Sacrifice and Service To Your Community and Our Country.

Web Who Are Non-QM Mortgages Best For. In addition a qualified mortgage is. Web With a non-QM mortgage you can get approved based on your bank statement deposits NOT tax returns.

But theyre often expensive. Web A non-QM loan has flexible terms lenient credit requirements and requires less documentation making it a great mortgage option for. Borrowers with less-than-stellar credit Self-employed borrowers Real estate investors Foreign nationals Small business owners People with a high DTI ratio Gig workers Independent contractors Retirees.

Angel Oak Mortgage Solutions another non-QM lender projected that its. Over 80 of Our Clients Were Told NO By Other Lenders. Web A non-QM is a good idea when you have the income to make regular on-time mortgage payments but cannot get a qualifying mortgage.

The lender will calculate your income based on average monthly deposits. This includes income sources. Imagine that you own a contracting business.

This gave mortgage lenders protection on loans that met standards. Web To understand a Non-QM loan you must understand what a QM or qualified mortgage means. The average credit score of homebuyers with non-QM in 2022 was 771 compared to 776 for homebuyers with QMs and 714 for government loans.

Nevertheless we have observed that non-QM loans have sustained an approximate 250 bps spread over the corresponding Freddie Mac survey rate see Factors Affecting Non-QM Mortgage. Non-qualified mortgages are best for borrowers who do not meet the requirements for conventional mortgages. A lender must make a good-faith effort to determine that you have the ability to repay your mortgage before you take it out.

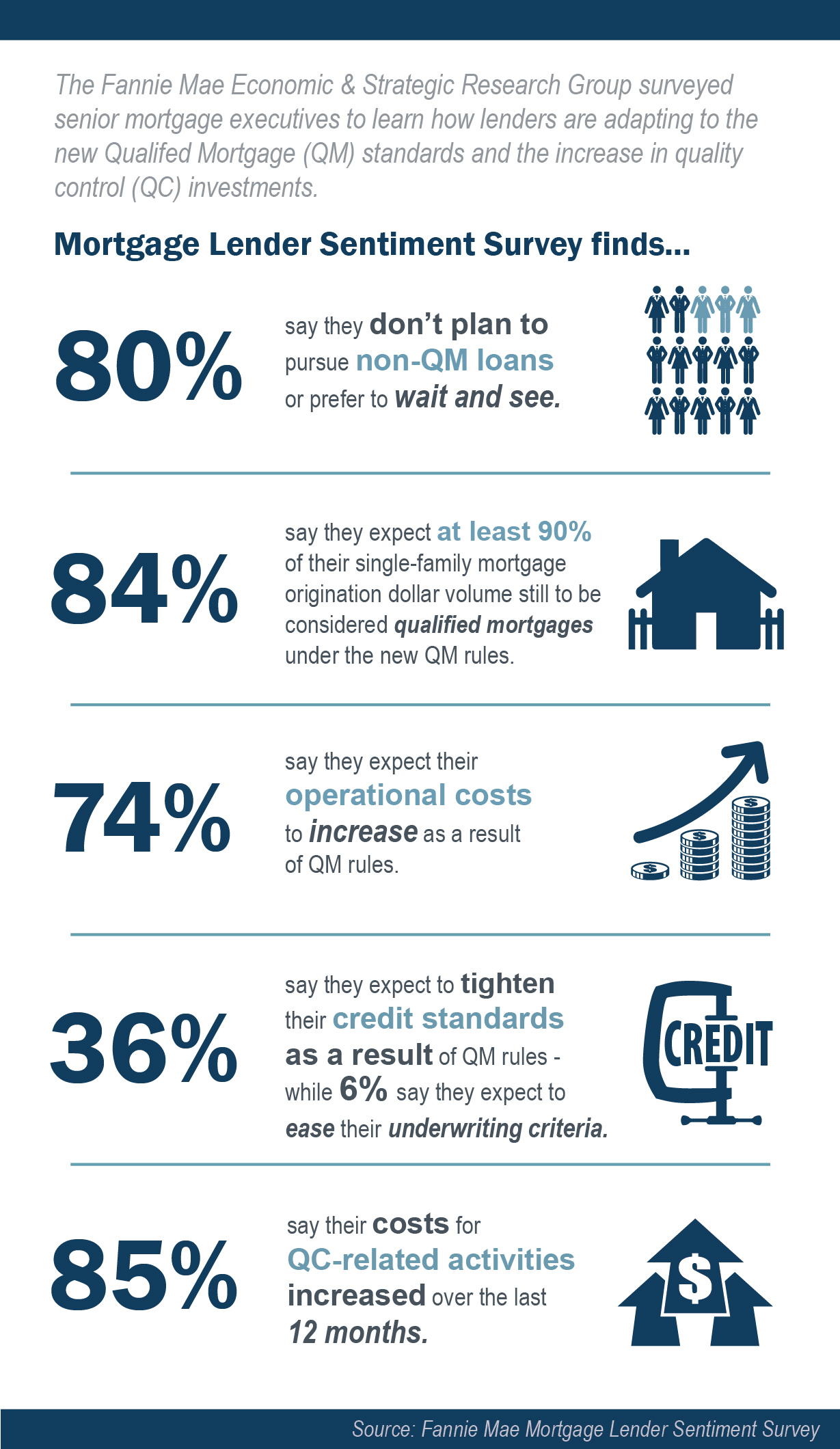

Web NonQM loans offer flexibility for lenders to offer mortgages to people who dont fit the criteria of QM loans but lenders still need to do the work of verifying the information provided. Web A Non-QM mortgage is a Non-Qualified Mortgage loan. In 2014 the Consumer Finance Protection Bureau CFPB adopted new rules that defined qualified mortgages QM.

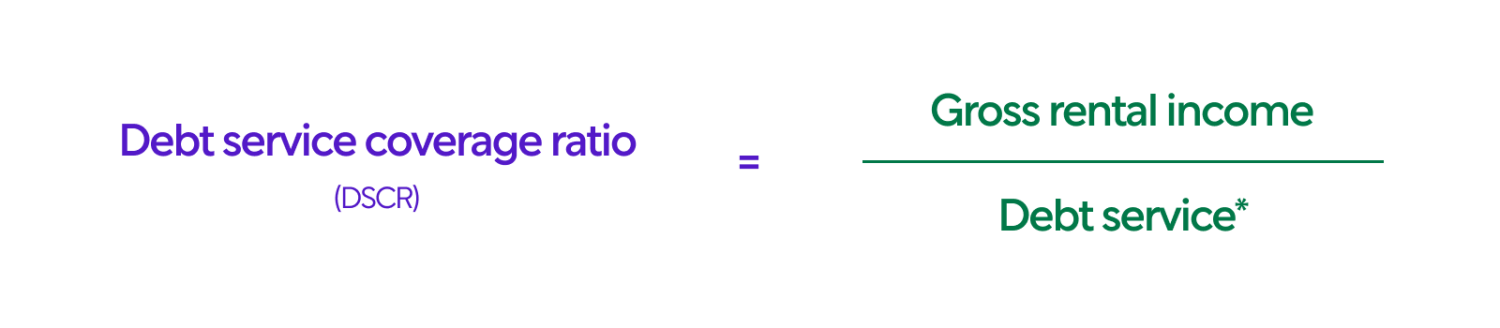

Credit score DTI and loan-to-value LTV ratio. On April 27 2021 the Bureau issued a final rule to extend the mandatory compliance date of the General QM Final Rule. Web The Team at Non-QM Mortgage Brokers is available 7 days a week evenings weekends and on holidays.

Web Because non-QM or non-prime mortgages are deemed riskier than prime loans in a normal market they typically command an interest rate about 150 basis points above conforming rates. Lenders must verify and document anything that supports the borrowers ability to repay. Web Non-QM Loan Definition.

A conventional mortgage FHA or VA loan are all considered qualified mortgage loans. The following people may benefit from non-QM mortgages.

What Is A Non Qualified Mortgage First Heritage Mortgage

Saying Yes To More Borrowers With Non Qm Loans Ad Mortgage

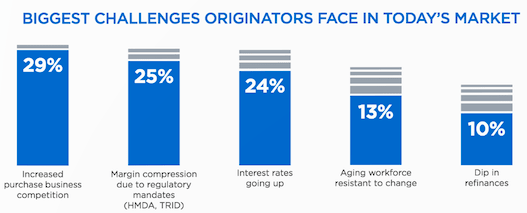

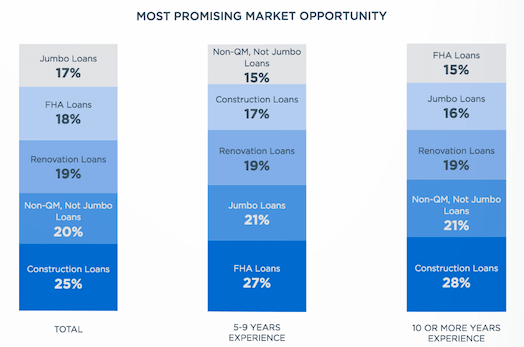

Non Qm Poised For 400 Growth In 2019 Non Qm Loans

Lendihome Inc Mortgage Loan Officer Partner Job Remote

What Is Non Qm Homexpress Mortgage Non Qm Loans

Non Qm Loans Subprime Vs Non Qualifying Mortgage Guaranteed Rate

Non Qm Poised For 400 Growth In 2019 Non Qm Loans

Fannie Mae 80 Of Lenders Won T Enter Non Qm Space Housingwire

What Are Non Qm Loans Or Asset Based Loans Better Mortgage

Why A Non Qm Loans Might Be For You Nj Lenders Corp

Calameo Gmat Official Guide 12th Edition

What Are Non Qm Loans Or Asset Based Loans Better Mortgage

Non Qm Mortgage Loans 5 Ways To Get Approved Successfully

Non Qm Loans Non Qualified Mortgage Lender Griffin Funding

List Of Top Non Qm Lenders Of 2023 Non Prime Mortgage Loans Non Prime Lenders Bad Credit Mortgages Stated Income Loans

Best Non Qm Lenders For 2023 Non Qm Loans Dream Home Financing

9zg Rfxgmm8vnm